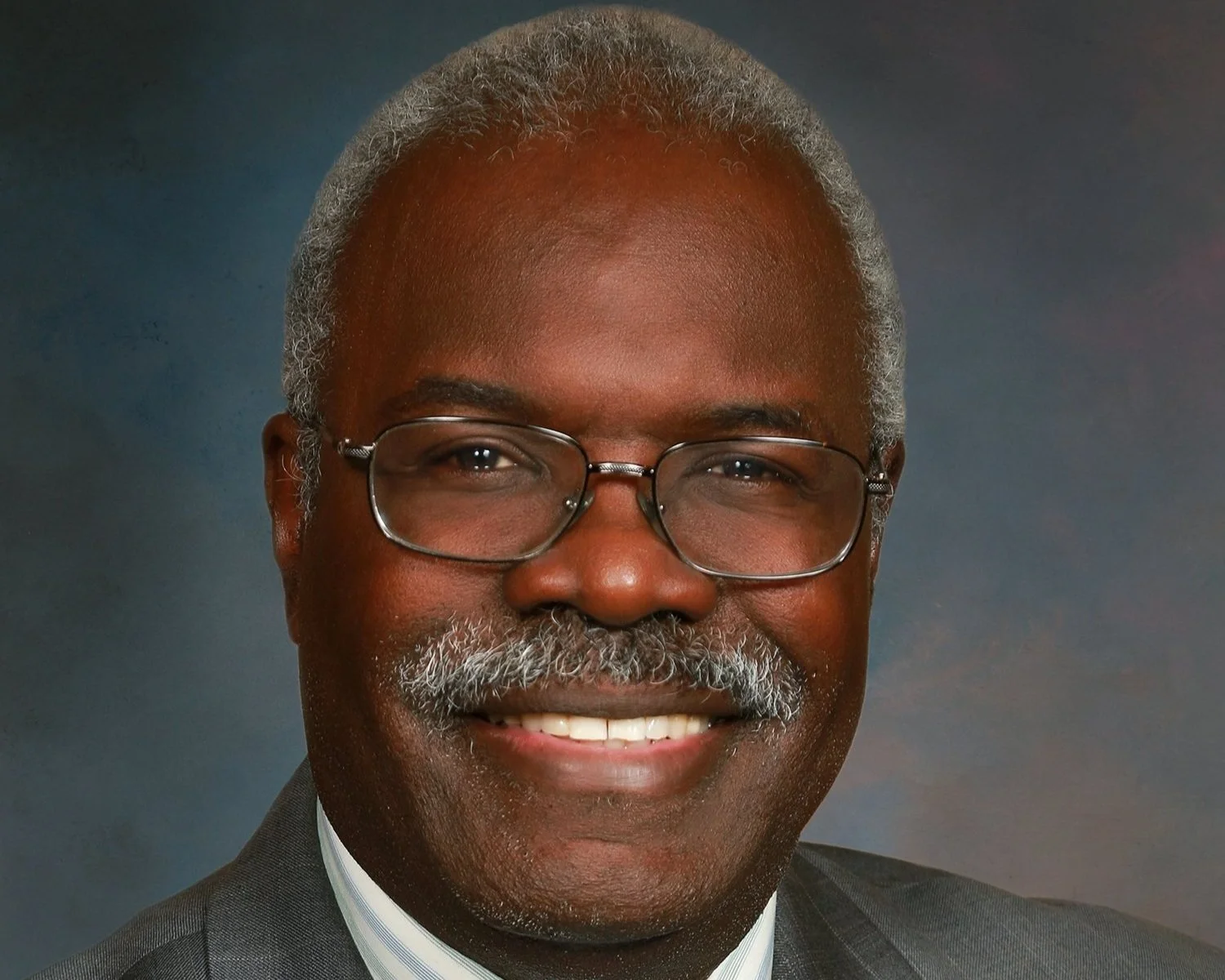

Building Bridges: An Experience With My Caribbean Actuarial Family by John Robinson, FSA, FCA, MAAA

An Experience With My Caribbean Actuarial Family, by John W. Robinson FSA, FCA, MAAA, SOA Past President and CAA Honourary Member.

Introduction

In my initial ambassadorial role as Past President of the Society of Actuaries (SOA), I was honoured to represent the SOA at the Caribbean Actuarial Association's (CAA) Annual Meeting, held from November 29 to December 1, 2023, in Port of Spain, Trinidad. I will start with some background information before sharing my insights on selected sessions.

Background

My actuarial career started in Jamaica in 1982. While there, the Jamaican actuarial community, under the informal but inspiring guidance of Daisy McFarlane-Coke, FIA 1970, would meet occasionally, officially every quarter, for networking. Following Daisy’s pioneering example, a number of bright mathematics students from the region accepted the challenge of becoming Fellows of esteemed bodies like the Institute of Actuaries (England), the Faculty of Actuaries (Scotland) or the Society of Actuaries (US). In 1991, the Caribbean Actuarial Association (CAA) was founded, with Daisy as one of its founding members. The association, now with 133 Fellows as members, is a Full Member of the IAA and is influential beyond its size.

While Caribbean actuaries may carry the same designations as others, they represent a unique brand. This uniqueness is rooted in their deep understanding of the fundamental drivers of their smaller economies. In contrast, an actuary in the US might spend a career focused on Variable Annuities, with limited interest in, or understanding of, key drivers outside of their specific domain.

Although I left Jamaica in 1985, I have maintained contact with my Caribbean actuarial family. My election as SOA president-elect in 2021 has been, and continues to be, a great source of pride for the CAA and its members. During the 2022 CAA Annual Meeting in Barbados, which I attended as SOA President, I was honoured to be made an Honorary Member of the CAA.

The 2023 CAA Annual Meeting

The theme for the conference was “Balancing The Equation: Shaping A Sustainable Future” which aptly captured the unique sustainability challenges faced by a collective of small island nations. The theme reflected the Caribbean actuarial community’s strong engagement with these complex issues.

Day 1:

The meeting began with an SOA Associateship Professionalism Course (APC), led by Lan Tong FSA, FCIA. In the session, 12 near-ASAs engaged in discussions about professionalism, with my role being to interject with “colour commentary” from time to time. APCs rarely involve an SOA presidential officer,

and the students appreciated my presence. For my part, it was a great privilege to participate in a key point in their career journey.

The afternoon session focused on Professionalism, this time for the purposes of the continuing professional development, for the Associate and Fellow attendees. We invited CAA Past President Kyle Rudden FSA, FIA, ACAS to present a Caribbean-context case study. This was important for understanding the unique conflicts of interest and other dilemmas that can arise in smaller countries, which might be overlooked in large nations. Lan, Kyle and I facilitated these discussions.

One hallmark of all CAA Annual Meetings is that they throw a good party. That evening, we were entertained by Sam Broverman ASA, who is not only a professor at the University of Toronto but also a professional singer.

Day 2

The second day featured presentations and discussions on Sustainability, related first to environmental issues and secondly to the state of the social security program in Trinidad, and IFRS 17.

Regarding environmental matters, there is a great global debate on the relative importance of Adaptation versus Mitigation. The debate in the Caribbean starts with the fact that they are affected by factors well beyond their control and have limited resources to address them. For example, the warming seas pose an existential threat to the coral reefs off the islands. Consequently, the crucial question arises: should Adaptation or Mitigation be prioritized? Notably, CAA members, with Bertha Pilgrim, FIA, at the forefront, are actively engaged in this conversation and are recognized as respected thought leaders in both the region and the International Actuarial Association (IAA).

Concerning regional social security issues, you will no doubt recall the recent outcry in France when the government proposed to increase the retirement age from 62 to 64; such issues can spark intense national debates with political implications. Derek Osborne FSA, a past president of the CAA, is the leading actuarial expert on social security programs across the region. The role of the actuary is to advise the government in its capacity as “plan sponsor”. The audience learned that these programs are all beset by problems related to changing demographics, limited financial resources, plan design anomalies and the timeliness of remedial action by the respective governments.

As for IFRS 17, it stands as the most actuarially complex accounting standard for life insurance in history, in my view. It is principle-based; in particular, it was not designed with Caribbean conditions in mind. While outside consultants have greatly assisted Caribbean actuaries in implementing the processes, IFRS 17 requires that assumptions be based on the company’s view. Consequently, Caribbean actuaries have set their minds to tackling the implementation of its principles in their own context. Two sessions were dedicated to updates on the current status and similar challenges faced by actuaries in the small European country of Estonia. (Yes, Marika Guralnik came to Trinidad all the way from Estonia!)

Day 3

I was privileged to serve as Moderator for the Presidents Round Table. As the title suggests, we heard from presidents Simone Brathwaite (CAA), Steve Prince (CIA), Micheline Dionne (IAA), Tim Rozar (SOA) and Neil Tagoe (Actuarial Society of Ghana). For Tim and Neil, it was their first visit to the Caribbean. We discussed issues in two categories: climate change and the future of the actuarial profession.

The final session that I will highlight is one on the development of Smart Tables. Named after, and developed by, Stokeley Smart, FSA and others, these tables are modeled on the Ogden Tables, which have been used to assist judges when they need to quantify loss of earnings in personal injury and fatal

accident court cases. The Smart Tables, specifically designed for application in the Caribbean, are set to be a significant addition to the region's actuarial resources.

Special Mention

I wish to thank Stokeley Smart, FSA and Cy-Anne Ali, FSA, for their significant contributions to planning and executing the conference. Stokeley, who heads the Actuarial Science degree program at the University of the West Indies in Trinidad, graciously invited me to give a presentation to a group of university and high school students. The event was live-streamed around the world – I even got a question from an attendee in Nigeria. Sharing my story and perspectives with them, and addressing their queries about our esteemed profession, was a truly enjoyable experience.

I also wish to congratulate Judith Veira FSA on her advancement from President-elect to President, and Nicola Barrett FSA, MAAA, for being elected as the new President-elect by the members.

Invitation

The 2024 CAA Annual Meeting will be held in the Bahamas. If you live any closer to the Caribbean than Estonia, please plan to attend.

John Robinson can be contacted at Jwrob03@gmail.com.